The phone buzzed at 7:12 a.m., and there it was: “Thanks for your payment.” Another tiny subscription I’d forgotten. I scrolled the bank feed, thumb slow, eyes catching the same £4.99, the same £8.99, different names, same sinking feeling. It’s quiet money, the kind that hides between rent and coffee, the kind your future self promises to deal with on Sunday — then doesn’t.

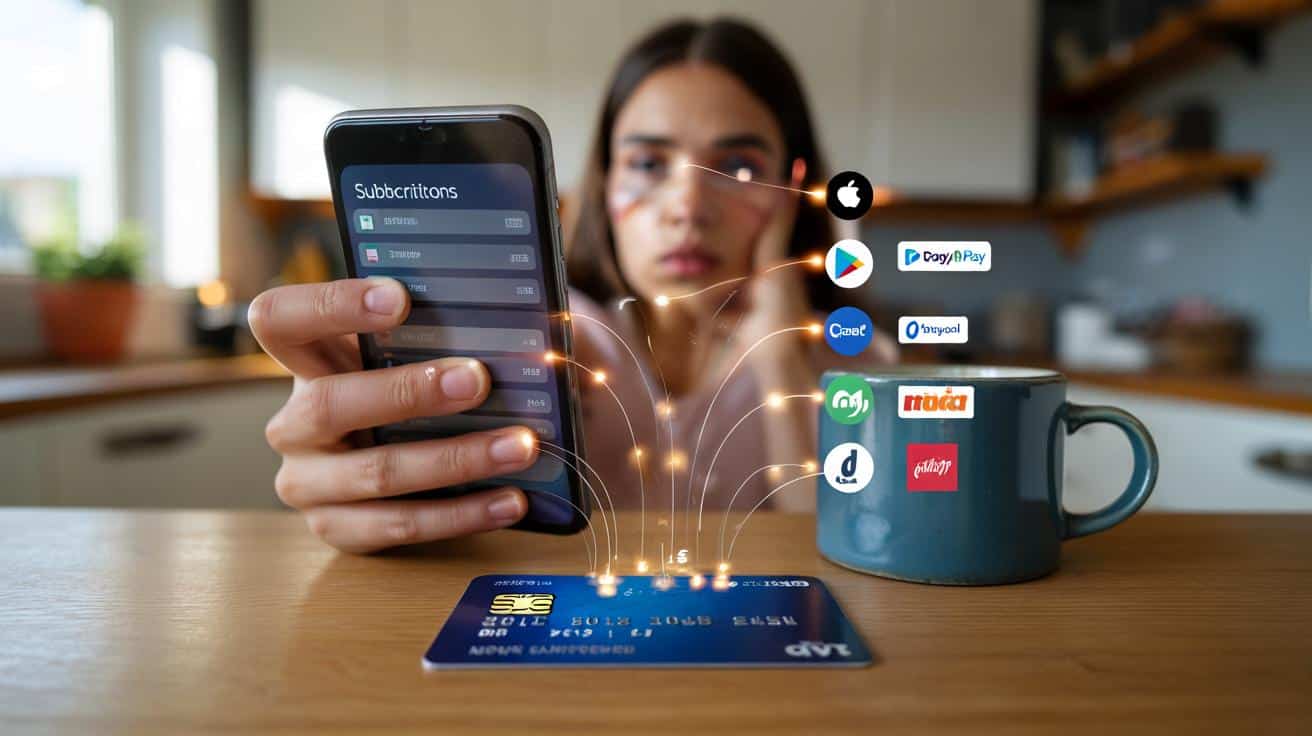

We’ve all had that moment when a friendly receipt lands like a pebble, and you sense a landslide behind it. Your card, it turns out, is very generous. The trick is to see everything at once, clearly, without playing whack-a-mole. There’s a way to do that. It starts with a simple tap, and a small shock.

The silent drain most people never see

Open your bank app and the feed looks busy, alive, under control. Then tap into “Recurring payments” or “Subscriptions,” and a different story appears. Names you half-remember. Trials that quietly grew up. Fees that look like pocket change but travel in packs.

What makes this sneaky is the blur. Merchant names morph into codes. A gym uses a billing partner. A streaming bundle splits into two. You see a total, not a pattern. *It feels like free money until the bill lands.* That’s how budgets leak, one courteous email at a time.

In the UK, a lot of this runs on Continuous Payment Authorities — card-on-file permissions that renew until you say stop. Direct debits usually sit front and centre. Card subscriptions hide. Monzo labels “Subscriptions & Direct Debits.” Starling surfaces “Regular Payments.” NatWest, Lloyds, Barclays and HSBC have “Manage regular payments” or “Subscriptions” views in-app. **The moment you tap that list, you’ll likely gasp.** Not from the big ones. From the stack of small ones you don’t use.

Here’s the kicker: many of these services move. Prices creep. That £5 trial graduates to £12.99. A year goes by and the vendor changes its descriptor, so you stop recognising it. One fintech put the average UK monthly spend on forgotten subs at over £300 a year across users. That’s not a latte. That’s your weekend away, gone by a thousand friendly emails.

Think of each subscription as a tiny tenancy on your card. Some are great tenants. Some never pay rent in value. The job is not to rage at them. It’s to list them, read them, and decide who stays.

The easy sweep: reveal every service in minutes

Start where the money actually leaves: your bank or card app. Open it and find the section labelled “Recurring payments,” “Regular card payments,” “Subscriptions,” or “Merchants.” Monzo and Starling make it obvious. Barclays, Lloyds, HSBC, NatWest and Halifax tuck it under “Manage payments.” You’ll see a grid or list of services that have charged you on a schedule. Tap each name to view frequency and last charge. Screenshot the whole view. That’s your map.

Next, gather the other pipes. Apple: Settings > [your name] > Subscriptions. Google Play: Play Store > your profile > Payments & subscriptions. PayPal: Settings > Payments > Manage automatic payments. Amazon: Account > Memberships & Subscriptions. These are the hubs where a card hides behind an account. Scan for trials, duplicate premium tiers, annual plans you forgot. **If a service lives in one of these hubs, cancel inside that hub so it actually stops.**

Then do the email pass. Search your inbox for “receipt,” “thanks for your payment,” “subscription,” “trial,” “auto-renew,” “invoice,” and “your plan.” Sort by newest. You’ll catch services that don’t show cleanly in banking dashboards, especially if they charge annually. Let’s be honest: nobody really does this every day. That’s fine. You only need one focused sweep to see it all. If a descriptor looks cryptic — like “GP*STREAM” — copy it into Google with “merchant descriptor.” You’ll find the real brand fast.

Common stumbles are completely normal. People cancel inside an app but forget the platform subscription behind it. Others remove a card in PayPal but don’t end the “pre-approved payment” itself. Some downgrade to “basic” and keep paying “pro” because the toggle lives on a different page. Breathe. You’re not failing. You’re navigating a maze built by professionals.

Watch the free trial timers. Many renew the second your clock runs out, down to the minute. Set a quick phone reminder the day before renewal. And if a company makes cancellation awkward, UK rules let you tell your bank to stop a CPA. You don’t need anyone’s permission to stop your own money leaving.

“The first time I opened my bank’s ‘Recurring payments’ screen, I found eight services I hadn’t used in months. I felt silly for five minutes, then saved £38 a month forever.” — Jade, Manchester

- Bank app: open the “Recurring payments/Subscriptions” view and screenshot the list.

- Platform hubs: cancel in Apple, Google Play, PayPal, and Amazon if the sub lives there.

- Email search: find annual or sneaky trials with simple keywords.

- Decode mystery names: paste the bank descriptor into Google to reveal the brand.

- Stop at source: if needed, ask your bank to cancel the continuous payment authority.

Make it stick without turning into a hobby

You don’t need a spreadsheet religion. Set a 15‑minute calendar event every two months called “Subscription sweep.” Open your bank’s recurring list, your Apple/Google/PayPal hubs, and search email for “renew.” That’s it. If you prefer automation, apps like Snoop, Emma, Moneyhub or Revolut’s Subscriptions can surface regular charges and push alerts before renewal. Keep a single note on your phone with three lines: what you kept, what you cut, next review date.

Use simple guardrails. Create a dedicated “trial” card or virtual card where possible, so trials can’t roll over silently. If a service is once-a-year, set a reminder one week before the anniversary. When a price rises, read the email. UK providers must give notice, and many will offer a cheaper tier in chat if you ask. **Say the honest line: “I like it, but the price doesn’t work for me — is there a lighter plan?”** The worst answer is no. The best saves your weekend away.

| Key point | Detail | Interest for the reader |

|---|---|---|

| Use your bank’s recurring payments view | Monzo, Starling, and major UK banks list card-based subscriptions under “Recurring/Regular payments.” | One tap reveals every active charge on your card, including CPAs. |

| Check platform hubs | Apple, Google Play, PayPal, and Amazon each hold their own subscription lists. | Cancel in the right place so charges actually stop. |

| Search your inbox | Keywords like “subscription,” “receipt,” and “auto-renew” surface annual or hidden services. | Find the ones that slip past bank dashboards and reminders. |

FAQ :

- How do I find every subscription charging my card right now?Open your bank app’s “Recurring/Regular payments” view, then check Apple/Google/PayPal/Amazon hubs, and run an inbox search for receipts and renewals.

- What if I don’t recognise a merchant name on my statement?Paste the descriptor into Google with “merchant” to find the brand, or scroll back in your email for that amount and date.

- Can my bank stop a subscription if a company won’t cancel it?Yes. Ask your bank to cancel the Continuous Payment Authority for that merchant. You can also dispute unwanted future charges.

- Is there a safe way to try services without getting stuck?Use a virtual card or a dedicated “trial” card, set a reminder a day before renewal, and keep trials in a single note.

- What apps can help track subscriptions in the UK?Try Snoop, Emma, Moneyhub, Plum, or Revolut’s Subscriptions. They flag recurring charges and nudge you before renewals.

Followed this step‑by‑step: bank’s Recurring Payments list, then Apple, then PayPal. Found five zombie subs (a “pro” tier I never used, a trial that grew up) and cancelled £23/month. The email search for “receipt” and “auto‑renew” worked suprisingly well. Cheers.

Nice tips, but is telling the bank to stop a CPA actually bulletproof? A gym re-billed me under a slightly different descriptor. Any recourse beyond a dispute?